Scale of emissions data flaws exposed

Autofile reveals hundreds of problems raised with agency over accuracy of CO2 ratings on Rightcar

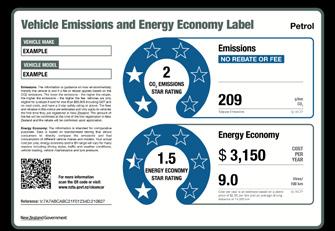

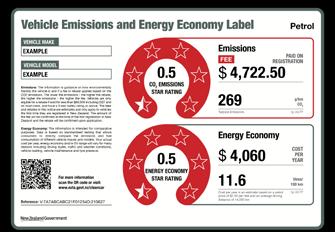

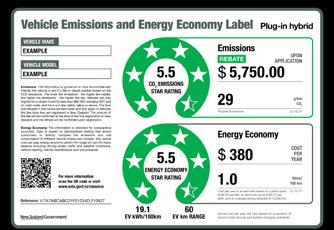

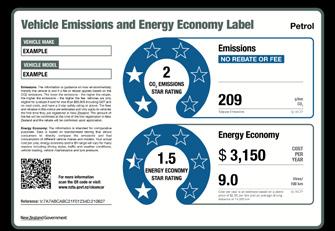

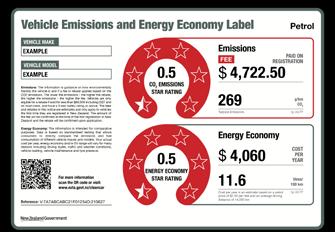

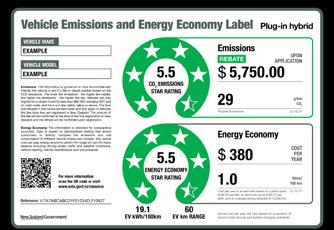

More than 300 complaints have been lodged with a government agency about incorrect carbon dioxide (CO2) data since the launch of the clean car discount.

Waka Kotahi has been required to review the fueleconomy figures of some 100 different models to see if rebates or charges apply to them, with the vast majority on the buying lists of used-car importers.

The car that has attracted the most complaints under the feebate scheme is the Toyota Aqua, which has numerous variants.

Problems experienced include buyers of this petrol hybrid being pinged with a fee instead of receiving a rebate despite it being a low-emissions vehicle.

The remainder of the top five models most complained about in the clean car discount’s first three months of operation were the Nissan NV200 and Note, and

the Toyota Raize and Corolla.

It’s not just the CO2 ratings of Japanese marques that have had issues raised on them, with dealers also taking umbrage with government figures concerning a host of European models.

These include the Volkswagen Golf, BMW 330e, i3 and 116i, Audi A1, A3 and Q5, and Mercedes-Benz GLC and C350.

As a result of complaints lodged with the transport agency, it refunded dozens of consumers between April 1

complaints

and June 30 because they were incorrectly charged.

The scale of issues with CO2 data on the Rightcar website are highlighted in statistics supplied by Waka Kotahi in response to an Official Information Act (OIA) request lodged by Autofile for the first three months of the feebate scheme.

During that period, the agency received 370 enquiries relating to incorrect emissions figures with 212 being made in April. Of those, 368 have been resolved with it

Clean

standard frustrates

GLOBAL VEHICLE LOGISTICS NZ - JAPAN - AUSTRALIA - UK - SINGAPORE OCTOBER 2022www.autofile.co.nz THE TRUSTED VOICE OF THE AUTO INDUSTRY FOR 35 YEARS [continued on page 4]

There have been many

about the Toyota Aqua’s CO2 data on Rightcar

car

Industry kept waiting for vital details of regulations p 9

VEHICLE SHIPPING

GENERAL FREIGHT

VEHICLE TRACKING

SHIPPING SCHEDULE

JACANNA.CO.NZ move to new, much larger premises means we are to offer even more services to our dealer clients BIGGER IS BETTER www.jacanna.co.nz Tel: +64 9 825 0888 Capping it all off is Jacanna’s SmartTrade Rewards Programme, you can earn points for almost any reward you choose to door ro-ro vehicle shipping from Japan and Australia Containerised vehicle shipping from anywhere in the world Vehicle tracking Approved MPI transitional facilities and cleaning services LOAD IT SHIP IT TRACK IT CLEAR IT DELIVER IT !

We are specialists in transporting and exporting all types of Vehicles, Commercial trucks, vehicles of Special Interest and other RORO Heavy Cargo & Machinery.

We have developed a worldwide network of Agents who understand the commitment required to service our demanding market.

Finding out where your vehicle is at any one time of the process, gives you the ability to manage the collection and processing of documents and payment on time.

TRS and shipping services from Japan to New Zealand. www.jacanna.co.nz info@jacanna.co.nz Tel: +64 9 825 0888 Terms and conditions apply.

Changes needed to ‘prescriptive’ regime

As I write, we are awaiting the second tranche of regulatory changes to the Credit Contracts and Consumer Finance Act (CCCFA) with the first – very minor – changes having been implemented in July.

Given the comprehensive review of the act and accompanying new regulations were only implemented on December 1 last year, it’s nothing short of extraordinary that a review was needed only weeks later and that consumer credit providers are now being faced with another set of such changes.

What’s so incredibly frustrating is that all of this could have easily been avoided had the government had even half an ear to the unintended consequences and poor outcomes clearly signalled to it by industry during the consultation process on the new regime.

Within the first three months of this year, FSF members reported the number of loan applications received had declined by 21 per cent, the number of applications they had approved had dropped by six per cent and the average time to make a decision had increased by 1.1 days.

August’s Centrix Credit Insights Report showed that new lending was down by a massive 40 per cent year on year.

There are obviously other factors at play that have led to this huge drop in new lending, such as record inflation significantly driving up the cost of living, but the CCCFA

bears much of the responsibility.

The statistics for motor-vehicle loans tell a similar story. Centrix data shows a drop in demand for such lending of nearly 20 per cent since January this year, while arrears on loans as of the end of August had jumped again for the fourth month running to 4.5 per cent. This is the highest reported level since early 2021.

It’s hoped further easing of the prescriptive CCCFA regulatory regime might reverse some of the restrictions on access to credit but, like anything, the devil will be in the detail.

The proposals announced last month by the Minister of Commerce and Consumer Affairs included narrowing the expenses required to be considered by lenders to exclude those deemed to be discretionary.

The problem officials are grappling with is what “discretionary” is. It would seem what I think is discretionary spending may be deemed by someone else to be entirely essential.

We saw more details as to how the proposed changes will be brought into effect in the regulations when an exposure draft was released on September 22. We’ve been given about a month to respond to these.

The final regulations will come into force from March 2023, so the CCCFA will continue to be the gift that keeps on giving for credit providers and car dealers alike for some time to come.

DIRECTORS

Brian McCutcheon

EDITOR

Darren Risby

JOURNALISTS

DESIGNER

Adrian

Entry Certification Specialists

www.autofile.co.nz 3 Vehicle Inspection NZ

• Entry Certification for imported cars • Vehicle Appraisals • Pre-Purchase Inspections • WoF • CoF • Road User Charges • Registration & relicensing • Exhaust emission testing 0800 GO VINZ VINZ.CO.NZ

Call Steve Owens now on 021 947 752 GUEST EDITORIAL

brian@autofile.co.nz ph. 021 455 775 Darren Wiltshire dazzz@autofile.co.nz ph. 021 0284 7428

Payne arpayne@gmail.com

ris@autofile.co.nz

Sue Brebner-Fox sue@autofile.co.nz Matthew Lowe matthew@autofile.co.nz MOTORSPORT Mark Baker veritas.nz@xtra.co.nz Autofile magazine is also available online as a readable file or downloadable as a PDF. Subscriptions are available at Autofile Online – www.autofile.co.nz Back copies are also available on the website. Copyright: Published monthly by 4Media Ltd All statements made, although based on information believed to be accurate and reliable, cannot be guaranteed, and no liability can be accepted for any errors or omissions. Reproduction of Autofile in print or digital format in whole or part without written permission, whether by copying or any other means, is strictly forbidden. All rights reserved. ISSN 0112-3475 (print) ISSN 2350-3181 (online)

LYN

McMORRAN Executive director Financial Services Federation Further easing criteria will boost lending for and sales of cars, argues Lyn McMorran

news

taking an average of nine days to close an enquiry.

By July 1, it had refunded fees in 32 instances when people were “incorrectly charged due to incorrect emissions data for a vehicle” with the total amount reimbursed coming in at $58,941.

The average amount of time it took Waka Kotahi to resolve issues when people were wrongly charged fees was 20 calendar days.

During those three months, the agency was unaware of any instances of incorrectly giving rebates under the feebate scheme, while the government holds no information on how many occasions it may have incorrectly classified that a light vehicle was “fee neutral”.

On top of all this, Waka Kotahi received 15 complaints about the administration of the clean car discount. Of those, five were about incorrect CO2 data. The remaining were related to fee and rebate enquiries, eligibility criteria and application issues.

Top models for CO2 complaints

The agency’s OIA reply states:

Rightcar website can be used to check whether an estimated fee, zero band or rebate is expected.

these are estimates until the point of registration.”

SCALE OF SITUATION

accessed by Autofile shows how officials have reacted to problems with the clean car discount and Rightcar’s CO2 ratings system post-launch.

email was issued on April 8 by ministerial services in response to enquiries about errors with the feebate scheme.

“Overall, the system is running well,” it states. “We’ve had some minor bedding-in issues with the transition to rebates and fees based on CO2 emissions as expected with any new process. These are isolated issues.

“We knew and acknowledged the historical data had some glitches, hence the VEED [Vehicle Efficiency and Emissions Data] Rule was developed to enable

Extent of

Many dealers have raised concerns about CO2 ratings on Rightcar, and the sheer number of different vehicles with inaccurate or incomplete emissions data sets illustrates the scale of the issue.

As well as models attracting eight or more complaints, those listed below were complained about between April 1 and June 30.

Seven complaints were raised about the Nissan X-Trail during that period, there were six concerning the Subaru XV, and Toyota RAV4 and Camry, and five about the BMW 330e and Ford Focus.

a hierarchy of testing cycles to calculate the CO2. We have a process we’ve shared with industry for them to request a review of the CO2 if they think it’s incorrect.

“The majority of issues are with used vehicles imported from Japan, which have multiple levels of sub-models that require manual checks. Our key messaging to industry has been to contact us as soon as they have a question so we can work with them to resolve the issue.”

The agency’s internal email of April 8 explains there have been some instances when dealers might have been supplying incorrect and or incomplete data, “which could result in the wrong CO2 and, therefore, the wrong rebate or fee could be calculated, others where the source data is incorrect”.

It adds: “We are working to resolve these issues as they are identified and to apply long-term fixes where required.”

Just three days later, on April 11, the situation was such that an investigation into Waka Kotahi’s data was required. This came to light when the agency was asked to “provide an update regarding

Those with four complaints were the Audi A1, Suzuki Swift, Toyota Prius and Volkswagen Golf.

Three complaints were lodged about the Audi Q5 and A3, BMW 116i, Fiat Ducato, Honda Fit, Lexus RX 450h, MercedesBenz GLC, Nissan Juke, Subaru Impreza, Toyota RAV4, GR86 and Wish, VW Tiguan.

There were two complaints about the Audi A6 and SQ2, BMW i3 and 320d, Chevrolet Sonic, Daihatsu Hijet, Ford EcoSport, Mazda CX-30 and Demio, Mercedes-Benz C350, Nissan AD, Serena and Vanette, Subaru Outback, Toyota Corolla, Sienta and Yaris.

complaint was made

4 www.autofile.co.nz

[continued from page 1]

One

problem If you are a forward thinking motor vehicle trader, or financier, looking for a trusted vehicle insurance partner, call Quest. Contact: Simon Moore 021 149 2266 SimonM@questinsurance.co.nz QUEST INSURANCE OFFERS: an independent choice Mechanical Breakdown Insurance – backed by AA Roadside Assist Comprehensive Motor Vehicle Insurance Lifestyle Protection Insurance Credit Contract Indemnity Insurance Mechanical Breakdown Insurance for Electric and Hybrid Vehicles Guaranteed Asset Protection Insurance This table shows the most-affected models as identified by Waka Kotahi for having enquiries made about possible inaccurate or incomplete emissions data sets for the purposes of the clean car discount between April 1 and June 30, 2022. This information was supplied to Autofile following an Official Information Act request.

1 Toyota Aqua 29 2 Nissan NV200 21 3 Toyota Raize 19 4= Toyota Corolla 17 4= Nissan Note 17 6 Renault Lutecia 13 7 Toyota C-HR 11 8= Mazda Axela 10 8= Toyota Prius 10 10= Lexus CT 200h 8 10= Mitsubishi Outlander 8 10= Toyota Alphard 8

“The

However,

Correspondence

An

There were 21 complaints about data for Nissan’s NV200 from April 1 to June 30

errors” with the feebate scheme.

By noon on that day, “some 113 vehicles had not been registered so no fees were paid, which required a manual review of the CO2 data”.

By then, the agency was also aware of three cases of petrol hybrids that had been registered, which should have received rebates but were charged fees.

The dealer registered them and paid the fees so customers could take possession of the vehicles. Waka Kotahi was then contacted to look into the emissions data.

The email states the agency determined fees were charged in error, refunded them and advised the customer to apply for a rebate.

COMPLAINTS ‘UNACCEPTABLE’

The Imported Motor Vehicle Industry Association (VIA) is “unsurprised” there were 370 complaints in the first three months of the full clean car discount scheme and that Waka Kotahi has had to issue refunds.

Kit Wilkerson, head of policy and strategy at VIA, which has withdrawn its support for the government’s clean-vehicle policies, describes the transport agency taking an average of 20

‘process’ is not fit for purpose and has led the industry to stop making complaints.

“As for most of the issues with the scheme’s CO2 ratings having affected used Japanese imports, we warned the agency that would be the case.

“It has built its vehicle identification tool on top of the motor vehicle register [MVR], which is a mess.

“New vehicles cannot have wrong CO2 values because what manufacturers declare is – by Waka Kotahi’s definition – correct.”

VIA reiterates its view that the government can fix issues centred on emissions ratings by establishing a data look-up and vehicle-matching tool “that’s built on a better data source”.

Wilkerson says: “However, we recognise the government doesn’t see that as its responsibility – the VEED Rule clearly states it is the importer’s responsibility to provide this information.

“Unfortunately, this leaves importers in the impossible spot of trying to source the information from manufacturers that do not support competition from parallel importers.”

The September 2022 issue of Autofile reported on a government official saying the clean car data “works well”

when the clean car standard is launched next year, “because while the industry has stopped complaining about issues affecting customers, we expect the industry to object when it’s their money”.

The association says it has received no feedback from the Ministry of Transport (MoT) or Waka Kotahi on its decision to withdraw support for the government’s clean-car policies some two months ago.

Wilkerson

adds: “Beyond Michael Wood, the Minister of Transport, expressing his hope that we continue to work constructively with his officials, our specific and stated concerns haven’t been raised by the government.”

Within hours of VIA’s announcement of July 27, Wood issued a statement describing the feebate scheme as a “huge success” and said the association’s views on reducing light-transport emissions remain important.

“I continue to engage with VIA and have asked senior officials at Waka Kotahi to commence an assessment of concerns they have raised to determine if we can iron out any remaining obstacles,” the minister said.

“I’m confident that, for the majority of Kiwis, the clean car discount is working as expected with correct rates charged. For those who have faced issues, Waka [continued on page 6]

Alpine A110, Audi A7, A4 and SQ8, BMW X2, 120i, 118i, M Sport Auto, 323i, M4, X1, X3, 420i and 530e, Ferrari F8 Tributo, Fiat 500, Ford Fairlane and Fiesta, Honda CR-Z, Hyundai Accent, Jaguar XF and F-Pace, Kia Carnival.

Lexus CT 200, ES 300h, GS 450h, LS 500h and NX 300h, Mazda 2, Biante, MX-30, RX-7, 3, Atenza, CX-3 and CX-5, Mercedes-Benz

and S350, MG5, Mitsubishi ASX, Galant and Lancer.

Nissan Lafesta, Leaf, March, Tiida, Wingroad, NV150, NV350 and Pathfinder, Peugeot 207 and Boxer, Porsche Cayenne, Subaru Forester, Toyota Estima, Highlander, Camry, Vitz, Spade, Harrier and Hiace, Volvo V40, XC40 and XC60, Volkswagen Beetle and Passat.

www.autofile.co.nz 5 Contact us today 09 966 1779 www.jevic.com SP E C I A L IS T S I N PRE‑SHIPMENT INSPECTIONS MPI biosecurity inspections Biosecurity decontamination Heat treatment NZTA border inspections Odometer verifications Pre-export appraisals ? Lost documentation reports

t news

Kotahi has worked with them to resolve the issues.”

Wood has conceded that, as with any new policy, there have been some “teething issues” with the implementation of the feebate scheme.

“However, it’s important these are in seen in the wider context. In its first year, the clean car discount has proven a huge success with more than 57,000 light electric and non-plug-in hybrid vehicles registered, resulting in significant emissions reductions across cars coming into New Zealand.

“It has also clearly influenced importers of vehicles, who in many cases have been importing loweremitting vehicles into the New Zealand market to meet demand. This is the scheme working, as it is meant to, to clean up our fleet.”

Autofile contacted the MoT, Wood’s office and Waka Kotahi on September 20 to see what stage the transport agency’s assessment was at, and if any issues highlighted by VIA have already been investigated or addressed.

A reply received three days later from a spokesman for Waka Kotahi states: “Senior officials met with VIA to hear the concerns they had raised. Largely, VIA’s concerns were based on the perceived inaccuracy of the Waka Kotahi data facility.

“Waka Kotahi carried out visits with dealers and importers selected by VIA, and found no evidence of inaccuracies.

“It was also agreed that Waka Kotahi would carry out auditing on VIA source data for vehicle

From April 1 to June 30, the transport agency was unaware of any instances of incorrectly giving rebates under the feebate scheme

Waka Kotahi refunded fees totalling $58,941 in 32 instances under the clean car discount between April 1 and June 30 due to “incorrect emissions data for a vehicle”

“flawed” database stepped up after having sales collapse because the website has wrong emissions figures for many vehicles.

Feringa, director of Select Autos Tauranga, had to refund a customer who had bought a 2013 Subaru XV after they were facing a $2,371 penalty. He expected it to fall into the zero band.

The deal came unstuck after it took three weeks to get its Rightcar data corrected by the transport agency.

The government holds no information on how many occasions it might have incorrectly classified that a light vehicle was “fee neutral”

CO2 calculations. Waka Kotahi is in the process of auditing the VIA data sources in order to assess the viability of adding this data.”

Meanwhile, the Motor Trade Association (MTA) has been busy fielding enquiries from its members about issues with the agency, the Rightcar website and incorrect CO2 data.

Tony Everett, sector manager –dealers, says: “We always knew the problem was greater than Waka Kotahi admitted publicly at the time the clean car discount came into force.

“From day one, we’ve heard of vehicles that should have been getting rebates being hit with fees – and vice-versa. We’re still hearing those reports from our dealer members.”

Everett points out the feebate scheme has been a substantial

piece of work “to be fair” and some minor errors were understandable.

That said, the number of complaints detailed in the reply to Autofile’s OIA request confirm problems are widespread and “more than just ‘bedding in’ issues as described by Waka Kotahi”.

Everett says the main thing now is to ensure that no one is left out of pocket. “We would expect Waka Kotahi to make absolutely sure no consumer has paid a charge they didn’t need to and, if they have, make it good.”

FEEBATE SYSTEM ‘FLAWED’

Elliot Feringa is one of many used-car dealers to have contacted Autofile since the launch of the clean car discount to express his frustrations about it.

He wants action by Waka Kotahi to fix problems with Rightcar’s

“I feel that as an industry we have rolled over and taken this, especially as the problems don’t appear to be fixed after more than a couple of months,” says Feringa.

“It’s been taking weeks to resolve inaccurate information about fees or rebates. That kind of delay needs to be fixed quickly. It’s time to say enough is enough.

As an industry, we haven’t pushed back and voiced our dissatisfaction loudly enough about how poorly executed this scheme is.

“We have the right to base buying decisions on information available to us. When that information is subject to change and without any recourse, it adds unnecessary uncertainty and potentially unexpected costs.

“Through no fault of our own we’re having to unwind deals. That’s unacceptable and we should be voicing our concerns about it.”

Feringa received another surprise when he went to register a 2018 Lexus IS 300 sedan and found it attracted a fee, despite it being what he describes as

Different issues with new vehicles

David Crawford, chief executive of the Motor Industry Association, describes Waka Kotahi’s manual review of the CO2 data as “not an unexpected outcome” when it comes to used-imported vehicles.

“Problems with the clean car discount are almost solely related to used imports and have arisen because of a lack of compliance data for vehicles in their source

markets,” he told Autofile.

“The new-car sector is very much of the view that what we do is within normal variances.”

As for the impact of inconsistencies with emissions ratings when it comes to the launch of the clean car standard, Crawford believes the situation will continue to be “problematic” for

the used-imports sector.

“As for the new-car sector, our problems stem from other issues. These are mainly that the transport agency’s portal for tracking CO2 will not be fully automated come December 1 when we need accounts set up and need to start tracking pre-delivery inspection

[PDI] dates in the MVR.”

Crawford explains that the point of obligation is when the vehicle is certified for entry into service. For the clean car standard, this will be when the PDI date is loaded into the MVR.

“With the system not being fully ready, we will want to ensure any vehicles we PDI ahead of January are recorded and those that we PDI in January need to be recorded accurately.”

[continued on page 8] news [continued from page 5]

David Crawford

6 www.autofile.co.nz

DON’T SWEAT THE ‘C’ WORD COMPLIANCE SHOULDN’T BE A DIRTY WORD. PROTECTA MAKES IT EASY. With the recent changes to the Credit Contracts and Consumer Finance Act (CCCFA), you can be assured that Protecta have got you and your customers insurance compliance needs covered every step of the way. Talk to us to find out more today! contact@protecta.co.nz | 0800 776 832 www.protecta.co.nz

the type of economical vehicle the government should be encouraging into the fleet.

He predominantly purchases vehicles from Australia, but also imports from Japan. He has yet to experience issues with Rightcar for Japanese vehicles, “but as soon as you step into other markets it’s like every second vehicle is problematic”.

As a result, Feringa has been checking the details of all his cars to ensure the charges or rebates are correct before trying to seal deals.

Another frustration is Waka Kotahi “taking around five or six days to respond to email enquiries”.

“I accept problems happen, but how we deal with them is what matters. There’s no acknowledgement from the NZTA that it’s got more than teething problems with the system.

“It would be good if the agency acknowledged there’s a problem and said if there’s something we as dealers believe is wrong, then here’s a dedicated number where someone can sort it out straight away rather than it taking weeks to fix.”

Other dealers who have raised concerns with Autofile include Marc Campbell, director of Milan Inspire Cars, which is based in Hamilton.

He had to delay selling a BMW and Mercedes-Benz from Japan while sourcing statements of

compliance from Germany to provide more accurate CO2 ratings than Rightcar’s.

“It was a shock to see one of them default to the maximum fee of $2,875 because the online dealer resource section had no emissions data for it,” says Campbell.

“The system is incredibly flawed. It’s the importer’s responsibility to get correct data to the NZTA, not the other way around. While this allows the agency to update its system so cars can be registered with the correct fees or rebates, it gets that information at my expense.

“I’m now turned off from importing cars because of the stress of having to pay more money for each one you

bring in. Dealers like me are going to say it’s all too hard because we’ll struggle to make money.”

Rod Hicks, who owns Wanaka Auto Sales, also ran into difficulties when the feebate scheme was launched.

He sold a 2020 Toyota C-HR hybrid, which he believed would attract a rebate of about $1,400. But he says Rightcar stated there would be a $1,897 fee and it took nearly two weeks before the problem was fixed on the website.

Hicks had another five more late-model hybrids, due to arrive around May, which showed up with “no information” on Rightcar.

They included a 2019 Nissan

Note e-Power X-Four – a four-wheeldrive variant with the small electric motor added onto the rear axle.

Then there were three Nissan Kicks e-Power Xs, model years 2020, 2021 and 2022, and all with the same specification and classification number.

“These are small SUVs powered by the system as used in the Note e-Power and meet the latest emissions standard,” he explains.

There was also a 2020 Subaru XV Hybrid, with the same specification and classification number as one he had already submitted.

“These joined the previous nine we had with either no data or incorrect data for.”

As for the bigger picture, Hicks says: “Dealers have woken up to the fact we now have to check every car on Rightcar and if there’s a problem, we need to get onto it.”

He adds Waka Kotahi should have a response time of 24 hours for queries about potentially inaccurate data, “rather than holding dealers at arm’s length for days on end”.

“I’ve adopted a process when I get a deregistered car with an export certificate. I keep those certificates until the vehicle has been complied and ratings in the government’s system are about what I think they should be.

“I will be checking the ratings all the time now.”

TOYOFUJI SHIPPING SCHEDULE

8 www.autofile.co.nz Contact: Adam Stone adam.stone@toyofujinz.co.nz www.toyofujinz.co.nz FROM JAPAN TO NEW ZEALAND ON TIME, EVERY TIME T/S = Tranship to next available TFS vessel Toyofuji vessels Voyage JAPAN NEW ZEALAND Moji Osaka Nagoya Yokohama Auckland Lyttelton Wellington Nelson Dream Angel 31 26 Sep 28 Sep 29 Sep 1 Oct 14 Oct 18 Oct 20 Oct T/S Trans Future 7 140 26 Sep 27 Sep 1 Oct 20 Oct 22 Oct 24 Oct 25 Oct New Century 1 175 11 Oct 12 Oct 15 Oct 5 Nov 8 Nov 10 Nov T/S Trans Future 5 144 24 Oct 25 Oct 29 Oct 17 Nov 19 Nov 21 Nov 22 Nov Trans Future 6 141 7 Nov 8 Nov 12 Nov 1 Dec 3 Dec 5 Dec 6 Dec

[continued from page 6]

news

Elliot Feringa, director of Select Autos Tauranga

“Dealers have woken up to the fact we now have to check every car on Rightcar”

– Rod Hicks

Clock ticking with standard

The new-vehicle sector is urging the government to finalise regulations sooner than later ahead of the clean car standard’s current proposed launch in January.

The Motor Industry Association (MIA) continues to impress on Michael Wood, the Minister for Transport, and his officials of the importance of getting this done so its members have enough time to roll out the systems that are needed.

Autofile has contacted Wood’s office on the way forward asking if the minister is considering delaying the scheme’s proposed start on January 1, if other launch dates are being explored, when any such announcement will be made and how much notice the industry will get on the way forward.

The reply, received on October 3 from a spokesperson for Wood, states: “The implementation

settings of the clean car standard are currently being finalised.

“Minister Wood expects to confirm these in the coming months. We expect to provide clarity to the industry as soon as possible.”

And a spokesperson for Waka Kotahi told Autofile on October 5: “We have been working closely with industry toward implementation to ensure industry have the information and tools they need to comply.”

David Crawford, chief executive officer of the MIA, says it’s the phrase “coming months” that’s of material concern to the newvehicle sector.

“We need clarification now and, if not now, no later than by the end of October if we are able to complete the development of our internal systems to enable the application of CO2 accounts required under the clean car standard.

Michael Wood, Minister for Transport, expects to confirm the clean car standard’s implementation settings “in the coming months”

“If we don’t have certainty by the end of October, then the government is asking us to carry on business with both hands tied up behind our backs.”

Crawford warns that finalising systems any later increases business risk because that would

hamper MIA members’ ability to properly comply with statutory and regulatory requirements.

“Officials and government are taking all the time they need to get their bits developed without realising that we also need to develop our own systems to comply with the regulations,” he adds.

“Until the regulations are gazetted, we don’t know what all the requirements are that we must comply with.”

As for the work and preparation of the clean car standard by the authorities, Crawford says: “The development of the standard’s systems and Waka Kotahi’s portal was working well until May this year.

“It then went silent for two months as the transport agency underwent a reorganisation and reallocation of staff working on it. That has led to flow-on effects with project delays. Two months

www.autofile.co.nz 9

[continued on page 10] news

were lost when they shouldn’t

“In our view, we also contend the Ministry of Transport was slow to begin work on the regulations.

“Oddly, both agencies blame each other for the delays and neither seem to want – at a leadership level – to accept accountability for delays.

“To be fair, Waka Kotahi has also had to contend with project scope. For example, importers of Class L vehicles – motorcycles and mopeds – are being required to set up CO2 accounts.

“This is because the act was written in a way that mistakenly led to them being included when the intention was that they would not be caught up in the clean car standard.”

BIDS TO DELAY START

The Imported Motor Vehicle Industry Association (VIA) and Motor Trade Association (MTA) are lobbying the government to delay the roll-out of the clean car standard.

“We are working closely with the Minister of Transport and his officials on the standard,” says Kit Wilkerson, VIA’s head of policy and strategy.

“We have strongly proposed to him that the start date for the standard is pushed back so Waka Kotahi can properly implement it.”

If there is a six-month delay to the launch of January 1, VIA contends then that should also apply to changes to weight bands in that they would also be reviewed in the June of each year.

“If that doesn’t happen, then used-vehicle importers will potentially lose the ability to collect six months of credits,” explains Wilkerson. “Some will be looking to hold these over

David Crawford, the MIA’s chief executive, says the Ministry of Transport and Waka Kotahi appear to be blaming “each other” for delays with the clean car standard

for three years because, by then, importing even Toyota Aquas will attract penalties.

“What we’re looking for is the whole clean car standard to be pushed back in its entirety for six months. This is because we are concerned about the impact it would otherwise have on the usedimports sector.

“As for the way forward and the standard, the government has been working on a decision for a while and we expect it to come out with something soon.”

Chief executive David Vinsen says: “VIA and the industry are working to reach a delay in the implementation of the clean car standard to enable the transport agency and industry to better

prepare for it. We are requesting this formally and legally.”

He describes the situation as “a live issue right now”, while answers to questions are yet to be announced because matters are so contentious.

The MTA is urging the government to postpone the launch of the clean car standard until at least April 1. It is concerned about the impact of the delay in issuing its regulations will have on the scheme’s introduction.

Tony Everett, sector manager – dealers, says: “The standard’s scheduled implementation on January 1 is looming large and still our members don’t have much of the detail they need to plan and prepare.

Targeting emissions

The clean car standard is being set up by the government to penalise importers of light vehicles with high carbon dioxide (CO2) emissions levels.

It is the second part of the clean car programme following the clean car discount in July 2021, which then became a full feebate scheme in April this year.

The standard, which will cause further disruption for the automotive market, is a supplyside mechanism that will rest on the shoulders of importers of new and used vehicles.

It has been created to progressively cut the CO2 emissions of light vehicles entering New Zealand from an average of 171gCO2/km today to 105g by 2025 – a reduction of almost 40 per cent.

The government believes importers will be able to meet this target by bringing in more electric vehicles, hybrids

and lower-emissions models.

Different goals will be set for suppliers to reflect their fleets under the standard. That said, they will have to ensure the average CO2 emissions are equal to, or less than, the target for its vehicles.

Those targets will also get progressively lower each year in order to help meet the government’s ambitions.

As the system works by averaging, models exceeding the CO2 target can be brought in if they are offset by enough zero and low-emissions vehicles.

Some vehicles will remain exempt from the standard, including those used for military operations, and agricultural vehicles and equipment.

Also exempt are scratch-built and modified vehicles certified by the Low Volume Vehicle Technical Association, vehicles with historic value and classic cars, and those built before January 1, 1919.

10 www.autofile.co.nz [continued from page 9] news Contact us now to find out more A better deal for the Motor Vehicle Trade Ph: 09 320 5646 www.autobridge.co.nz n Flexible credit facility available to fund vehicles in transit or on your yard n Access to stock when you want to buy, not only when you have the available cash n Free up your capital and grow your business n Only available to registered motor vehicle traders

have been.

“Used-import dealers have very little information on how the scheme will apply to them.

“They are now in the situation of ordering vehicle stock, which might not arrive until early December, and yet they still have no information on how the clean car standard will be administered, including what fees or credits will apply, how they will trade credits, or the importer registration requirements and process.”

Everett adds the scheme needs to be fit for purpose from the getgo and not bedevilled by “bedding in” problems.

“We appreciate Waka Kotahi is working very hard on this. But the scheme either needs to be comprehensive, tested and trusted or delayed until it is. We have urged the Minister of Transport to consider doing so until April 1 at the earliest.”

ENTRY-COMPLIANCE ISSUES

The more time that passes before the government issues and

implements settings for the clean car standard, which it says are “currently being finalised”, the more pressure falls on the industry.

Matters of entry compliance, for example, will be the responsibility of Waka Kotahi’s key service delivery partners (KSDPs).

For that to go smoothly, the KSDPs need to know what changes there will be to the vehicle inspection requirements manual (VIRM) and what the other regulatory matters are. Then there’s staff training and internal systems to sort out.

Jonathan Sergel, general manager of motoring services at the AA, says: “We have got none of the information to hand about anything that we need for the implementation of the clean car standard.

“We’re now getting very concerned that processes –for example, changes to the VIRM – will happen without any correspondence with the trade. We will be talking with Waka Kotahi

The last thing the AA wants, says Jonathan Sergel, is to be forced to hold used imports at compliance because of processing issues when dealers want to sell their cars

about these matters at our next monthly meeting.

“The situation we are in is very frustrating because there’s Christmas approaching and places will close or slow down from December 23, so that will be seven to 10 days lost.

“There doesn’t seem to be any learnings with all this from the clean car discount. There have been unintended consequences with that and unintended consequences will no doubt happen in this case as well.

“The last thing we want is to be

forced to hold cars at compliance when dealers want to sell them because of processing issues.”

Sergel notes the buying of used vehicles in Japan for importation into New Zealand isn’t at the high levels seen early this year in anticipation of the feebate scheme’s launch. In addition, there are now more logistical issues with getting cars here now than there were back then.

That said, there could be a push by importers to get stock through the system before the clean car standard starts and the impact this could cause also needs to be considered.

As for staff training to get the job done at entry-certification level, Sergel says this cannot happen until it is known what’s required.

“All of this takes time. We are concerned the industry will be hand-braked by these delays. As we get ever closer to the start date, we’re getting more concerned and asking more questions.”

www.autofile.co.nz 11 Why not ask what SBL can do for you? Every year we import thousands of vehicles into New Zealand. We manage every detail of the importing process from Japan to your door. For our approved customers SBL Finance can provide flexibility in funding a vehicle’s purchase. Ph. 03 377 6578 www.sbltd.co.nz Call us now and find out what everybody’s talking about. t news

Getting on-board electric switch

Amajor player in the used-imports industry has seen its proportion of electrified vehicle sales increase as the government’s clean car discount continues to influence consumer demand.

NZ Automotive Investments (NZAI) estimates its overall market share of sales has increased to 7.4 per cent during the first four months of the current financial year.

That’s up from 6.9 per cent compared to April 1 to July 31, 2021, and this has been achieved despite used cars registered for the first time dropping by 10.9 per cent over that period.

Haydn Marks, chief financial officer, says that as a result of the clean car discount’s launch and higher fuel costs, 40 per cent of all 2 Cheap Cars’ sales during this period were electric vehicles (EVs) and hybrid EVs (HEVs) – up from 21 per cent on 2021/22’s first four months.

As for performance, unaudited figures show revenue and income climbing by 10 per cent to some $27.7 million, “largely on the back of inflationary price increases on vehicles”.

Marks adds: “The contribution margin is down $500,000 due to the impact of changes to the Credit Contracts and Consumer Finance Act [CCCFA] and slightly lower vehicle-sale volumes.”

Some of NZAI’s priorities have been outlined. Gordon Shaw, interim chief executive officer, says its success relies on four key factors. These include flexibility to quickly react to changes in the industry and strict discipline when it comes to containing costs.

Others are ensuring any investment is subject to robust scrutiny and generates appropriate returns. Another is improving finance and insurance (F&I) penetration rates.

“We are examining and recalibrating the core business, which will improve financial performance and rebuild shareholder value,” explains Shaw.

NZ Automotive Investments’ performance

APRIL 1-JULY

2022 APRIL 1-JULY 31, 2021

Vehicle sales 3,028 3,164

Revenue & income $27.7m $25.1m

Cost of goods $22.7m $19.5m

Contribution margin $5.0m $5.6m

Operating costs $3.3m $2.9m

EBITDA $1.7m $2.7m

Underlying EBITDA* $2.0m $2.7m

NPAT $0.7m $1.4m

Underlying NPAT* $0.8m $1.4m

to navigate omicron in April.

“Despite this and other distractions, the automotive retail side has had a reasonable performance in the first four months of the financial year selling on average 779 vehicles per month from May onwards.”

Unaudited revenue from sales between April 1 and July 31 was $24.9m, up by 13 per cent on last year despite 3,028 units registered dropping by 4.3 per cent from 3,164.

“We have already identified measures we believe will lead to improved cost-efficiencies.”

These include:

Reconfiguring workflow at the vehicle-processing hub in Onehunga, south Auckland.

Further reducing outsourcing and expanding car-preparation activities at the hub.

Strengthening key supplier partnerships and expanding networks.

The company recognises market conditions and access to credit has tightened due – in part –to December’s amendments to the CCCFA. “Strengthening partnerships with our F&I providers and ensuring our branch network is sufficiently trained to maximise sales in this area is a critical first step,” says Shaw.

Also, NZAI’s management and organisational structure is being reviewed to ensure it is appropriate for the business’ size and scale, that

it’s cost-effective and it enables the company to operate efficiently.

Shaw adds: “One of our key strengths is our Japan-based procurement team, enabling us to hand-pick the best cars for the New Zealand market. We’re committed to repositioning for sustainable growth and turning the profitability tide in the shortest timeframe possible.”

NZAI says the first four months of the current financial year have been challenging “with inflationary pressure, economic uncertainty and rising interest rates contributing to a tightening of household budgets”.

“In addition, a considerable amount of time has been spent managing changes at board and senior leadership levels,” states a trading update issued ahead of the company’s annual meeting in September.

“It was a slower start to the financial year in terms of vehicle sales with the business continuing

This reflects price increases on vehicles sold being passed on to cover the rising cost of cars bought in Japan. “Gross margins over the period were tight but improved from June onwards once pricing adjustments were made.”

Vehicle finance income “had a slow start” – down by nearly 15.7 per cent compared to April 1 to July 31, 2021 – while the number of cars sold with finance dropped by 21 per cent.

NZAI’s investment in marketing, fewer sales and reduced F&I performance were factors in net profit after tax (NPAT) dropping to $828,000 compared to $1.36m in the same period last year.

Operating cashflow improved to $3.9m, up from $2.3m, which has been attributed to a 22 per cent reduction in inventory levels since the end of March.

The company says it’s in a sound financial position and – as of July 31 – was compliant with its banking covenants and cash of $6.4m, net debt of $4.9m and total equity of $15.5m.

Lending has been paused on the finance company’s loan book, which is being reviewed, with its value dropping by $500,000 to $6.3m by the end of July.

Statutory NPAT, which included a one-off gain on rearranging leases associated with moving 2 Cheap Cars’ vehicle-processing hub from Mount Wellington to Onehunga, was $2.6m, down by $600,000 on 2021/22.

engine room

Excluding the gain, underlying NPAT was $1.7m, down 55.7 per cent from $3.8m.

news 12 www.autofile.co.nz

31,

*Excl restructuring costs due to board changes and non-recurring consulting costs. Underlying EBITDA and underlying NPAT are non-IFRS measures. Numbers unaudited. Source: NZAI NZ AUTOMOTIVE INVESTMENTS | FY22 ASM Presentation 3 Welcome to The Hub 102 Mays Road Onehunga The

of NZ Automotive Investments NZ AUTOMOTIVE INVESTMENTS | 2022 ASM Presentation 2 Cheap Cars’ processing hub in Auckland

www.autofile.co.nz 13

Business as usual on stink bugs

Biosecurity New Zealand officers have been back on the ground in Japan conducting in-person checks of border-inspection organisations (BIOs) for the first time since the start of the Covid-19 pandemic.

Officials were visiting approved facilities last month after having performed the auditing process virtually from this country over the past two years.

It’s the main change by government officials for the current brown marmorated stink bug (BMSB) season, which began on September 1 and runs until April 30.

Biosecurity NZ recalled staff from Japan in March 2020 in the early stages of the global pandemic, which meant the verification of used-imported vehicles had to be conducted onshore here.

A year later, it announced its officers would be remaining in New Zealand permanently and transitional facilities were set up to cut delays in discharging vehicles at ports.

Eight transitional facilities have now been established in Auckland, Wellington, Nelson and Christchurch and, when necessary, vehicles are taken for treatment and reinspection at these facilities rather than the whole procedure being done dockside.

The import health standard (IHS) for vehicles, machinery and parts that was in force during the last BMSB season has not been altered for 2022/23 and 38 countries remain on the high-risk list.

In August last year, the Ministry of Primary Industries (MPI) said it would continue to monitor stink-bug situations in the UK and Chile to see whether those countries should also be subject to schedule-three requirements.

A Biosecurity NZ spokesperson says no updates to procedures for tackling BMSBs was made this year following a review of the previous season and overseas developments this year.

“We decided the risk levels haven’t changed sufficiently to justify changes to the existing IHS at this stage.

“There have been no significant changes to processes, other than the resumption of biosecurity personnel undertaking audits in person of Japan-based inspection and cleaning facilities. This auditing was managed virtually during the pandemic.

“There have, however, been some tweaks to the IHS for sea containers. These include introducing a permanent requirement for containers and goods from Italy to undergo offshore treatment. This requirement was initially introduced as a temporary measure in 2018.”

The spokesperson notes the first car carrier of the current season with BMSB-risk cargo was met by quarantine staff when it arrived in Auckland on September 19. No live bugs were detected.

“Onshore clearance is now business as usual for our border biosecurity teams. A consistent approach to inspections has led to faster clearance times and we plan to continue with this approach for the 2022/23 season.”

Blain Paterson, general manager of Toyofuji, says everyone appeared to get through the last BMSB season “without too many problems” and adds the MPI has set a standard that’s satisfactory for all parties.

He notes the approach adopted by Biosecurity NZ last season for clearing vessels from the ports was an improvement on the previous method when inspectors were first recalled from Japan.

“[The new system] was better than what we had previously because sometimes they were inspecting 100 per cent of vehicles for some BIOs,” says Paterson. “With all their studies, they were able to refine the process and now the MPI checks fewer vehicles per vessel.

“Shipping companies would prefer to still have the MPI in Japan, but we have to work with the system we have.”

While onshore processes for handling imported vehicles are now well-established, there are industry concerns the return of passenger shipping following the reopening of our borders to tourists will put extra pressure on MPI staff and resources.

For BIOs based in Japan, it’s business as usual. Jacob Bates,

general manager of Automotive Technologies Ltd (ATL), says no changes to the BMSB heattreatment regulations this year indicates current systems are managing the risk.

“ATL will continue to follow its existing MPI-approved processes and continue to communicate with the MPI about any potential changes or emerging risks,” he adds.

“The MPI’s expectation is that biosecurity risks are managed offshore, thereby reducing the risk of biosecurity incursions in New Zealand. This expectation is not going to change.”

Bates says there have been media reports in Japan of high populations of stink bugs this summer and more than 20 prefectures have issued warnings to fresh produce growers of potential crop damage.

“This is likely to lead to more interceptions of stink bugs as we move into the heat-treatment season and stink bugs start to search for areas to overwinter –inside used vehicles, for example,” he adds. “ATL keeps a constant eye on these developments and will manage the risks as they emerge.”

Keisuke Nagashima, director of Bordercheck, has also heard similar reports of BMSB numbers being higher than in recent seasons. He says the company will ensure it “maintains the quality of our work and that the right processes are in place”.

“The risk from stink bugs last season seemed lower than in the past, but that risk can differ from season to season. The numbers we encountered were nowhere near what we thought they would be and were well down from 2018-19 when we had the highest numbers.

“There’s talk this season could be larger than last year. It’s still quite warm in Japan and bugs are still feeding. It won’t be until the weather starts getting cooler that they start to find hiding places in vehicles and, as a result, we’ll start to see them pop up in heat chambers.”

14 www.autofile.co.nz news

“A consistent approach to inspections has led to faster clearance times and we plan to continue with this approach”

– Biosecurity NZ

‘Sensible approach’ to loans

The Financial Services Federation (FSF) hopes the latest round of changes to lending laws will enable consumers to get more access to loans.

It’s also keeping its fingers crossed that the latest amendments to the Credit Contracts and Consumer Finance Act (CCCFA) being proposed by the government will be the last for some time.

That said, the federation says the changes now on the table will come at a cost to finance companies and motor-vehicle traders when they unwind some processes put in place ahead of December 1’s shake-up of the CCCFA.

The government has already tweaked the legislation this year, and the extra changes aimed at remedying remaining unintended impacts are out for public consultation until 5pm on October 20.

These measures aim to narrow the expenses considered by finance companies, and relax assumptions lenders have needed to make about buy-now, pay-later schemes and credit cards.

Also part of an exposure draft released by the Ministry of Business, Innovation and Employment (MBIE) on September 22 is helping to make debt refinancing or consolidation more accessible if appropriate for borrowers.

The latest measures are described by Lyn McMorran, the FSF’s executive director, as a “big improvement” on the “minor” tweaks that came into force in July.

“This exposure draft looks to have a more sensible approach to how discretionary expenses are taken into account by lenders,” she told Autofile.

The FSF had yet to get feedback from its members by the end of last month as to how to respond to the consultation document, “but on first take it looks much better than the first round of changes”.

McMorran adds: “The last time we responded to government ‘tweaks’, our submission ran to 30 pages so this one will be another

big one to ensure the interpretation of the CCCFA is correct.

“It would be nice to think that once these changes are implemented, they will free up access to credit and put this legislation to bed for a while so everyone can get on with doing business.”

The latest proposals will remove the need for detailed conversations with consumers around discretionary expenses and will allow them to take control over their expenditure, which is what the FSF was hoping for.

“I think the new rules will allow lenders to consider a consumer’s fixed expenses and then whatever is discretionary is treated exactly as that,” says McMorran.

“Even if consumers continue with discretionary items, they still have an obligation to meet their loan commitments, but these changes will give the power back to them again.

“It might make processing times shorter because lenders won’t have to go through every single expense line and ask whether those outgoings will continue once the loan is drawn down.”

David Clark, Minister of Commerce and Consumer Affairs, announced the first round of changes to the laws in March following a drastic decline in the percentage of loans being approved since last December’s CCCFA amendments.

He revealed more changes in August after a review of the implementation of the legislation by the Council of Financial Regulators and MBIE.

Have your say

Public consultation on extra changes to the CCCFA’s regulations and responsible lending code close on October 20.

This follows a government announcement by David Clark, Minister of Commerce and Consumer Affairs, in August.

“We encourage you to provide feedback on the exposure drafts to ensure the changes work in practice and do not result in any unintended consequences,” says a spokesman for MBIE. “Your feedback will be used to improve the design of the regulations and code. Following consultation, the changes are expected to be in force in March 2023.”

To make a submission, visit www.mbie.govt.nz/have-your-say/ and scroll down for the CCCFA link.

While those measures are now out for consultation, MBIE notes the changes to regulations and the responsible lending code aren’t expected to come into force until March 2023.

McMorran says the compliance costs borne by finance companies to get ready for the regime that came in on December 1 were massive, “in the millions for some larger lenders and proportionately large for lenders of all sizes”.

They included changes to documents, significant project costs and those associated with systems changes, staff, and car dealer and agent training.

There will be costs, although probably not as significant, to unwind processes particularly when it comes to staff training and systems changes.

McMorran laments that FSF members will have spent 15 months operating within a “prescriptive, silly regime” that it warned the government wasn’t going to work. She adds changes and consultations since December could also have been avoided if the industry had been listened to.

“This should never have happened if there had been some sort of process in government to check regulation, particularly when industry was so opposed and put up reasoned arguments against it.

“Those reasons weren’t just for the sake of self-interest, but also because of the clear impact it would have on consumers. However, we weren’t listened to.

“Another aspect the government should be ashamed of is the very short timeframe to implement such huge change – from the final responsible lending code landing in February 2021, which finalised what exactly lenders were required to comply with, through to implementation by December 1.”

That was pushed out from the original October 1 date only because of the Covid-19 lockdown late last year.

McMorran adds: “This put huge stress on our members to get there by the due date despite directly explaining to the minister the logistics of running such a huge project and pleading for a longer implementation timeframe.

“We’re now pleased to be getting to a sensible place next year, but it’s frustrating having had so many months of suffering for a regime that was badly put together in the first place.”

www.autofile.co.nz 15

news

The FSF hopes the latest changes to the CCCFA will make loan-processing times shorter

Diamond delight for dealers

Nine dealerships clinched top honours as Mitsubishi Motors New Zealand (MMNZ) celebrated the best performers across its 59-site network during an “excellent” year for the marque.

The main winners at the annual Diamond Dealer Awards included Ingham Mitsubishi Te Awamutu, Piako Mitsubishi Te Aroha, Bay City Mitsubishi in Tauranga and Christchurch Mitsubishi.

Others were Piako Mitsubishi Morrinsville, WR Phillips Mitsubishi in New Plymouth, Brendan Foot Mitsubishi in Lower Hutt, Wairarapa Mitsubishi and Baigent Motors in Matamata.

Piako Mitsubishi has won more awards than any other dealership in the network and this year’s was its 13th trophy.

Darrell and Catherine Russell, who run the business, also took home the supreme award, a new honour introduced for the highest overall points scorer in the Diamond Dealer competition.

Daniel Cook, MMNZ’s chief operating officer, says the black-tie function in Taupo was a chance to recognise the marque’s 23,665 sales in its 2022 financial year, and celebrate a period that saw “goals accomplished, records smashed and growth sustained”.

“We are proud of all our dealers

and we rightly celebrate their achievements through our awards night. This isn’t just a chance for a pat on the back, it’s an opportunity to inspire our team to even greater heights.”

Other highlights among this year’s successes included Ingham Mitsubishi Te Awamutu being firsttime winners after increasing its sales by 108 per cent.

Bay City Mitsubishi clinched its ninth win in a row and 12th overall, and Baigent Motors won its seventh consecutive award. WR Phillips Mitsubishi and Brendan Foot Mitsubishi also recorded back-to-back successes.

Other awards on the night went

to Andrew Simms Mitsubishi –Newmarket, Brendan Foot Mitsubishi and Piako Mitsubishi Morrinsville for top new-vehicle sales.

Prizes for best market share were taken out by West City Mitsubishi, Piako Mitsubishi Rotorua and Archibald Motors Kaitaia.

Simon Lucas Mitsubishi prevailed in the service category and Baigent Motors was honoured for parts excellence.

Gongs for excellence in customer service were given to Stephen Duff Mitsubishi, Piako Mitsubishi Rotorua, Saunders Mitsubishi and Baigent Motors. The managing director’s award went to Southern Lakes Mitsubishi.

Sales model changes

Mercedes-Benz has launched an agency model in New Zealand, which sees the end of the negotiation stage for consumers and means franchises receive a set fee for each vehicle sold.

The company has dropped its dealership model in favour of the fixed-price system whereby the distributor sets the retail price of cars and retains ownership of stock.

Franchises’ contracts with Mercedes-Benz NZ have changed as a result and there are 22 “retailers” acting as agents for the marque.

The German carmaker revealed in August 2020 that the shift was coming to this country as it sought to digitalise more of its sales and after-sales experience.

Its agency model has already been introduced in Austria, Sweden and South Africa. It was also launched in Australia in January, but has attracted controversy there

with 38 dealers taking federal court action against Mercedes-Benz seeking compensation of about NZ$700 million.

The company’s New Zealand website outlines the main changes to its business operations under what it calls an “enhanced ownership experience”.

It says: “We’ve introduced pricing certainty to give you the assurance that once you have found the Mercedes-Benz of your dreams, no matter where you buy it, there will be no better offer in the country at that moment in time.

“All of our agents have access to the same stock, so you will now be able to choose [what’s] right for you from our entire stock pool regardless of where you choose to purchase the vehicle.”

Mercedes-Benz NZ joins Honda and Toyota as marques operating under an agency model in this country. It has also announced it aims to open an online store this year.

16 www.autofile.co.nz We are looking for NZ new Fords and Mazdas. Ideally 2012 or newer with less than 150,000km If you have something you'd like priced, contact Jason: 0274 133 222 | jason.robb@southaucklandmotors.co.nz

news

It was smiles all round for the winners at Mitsubishi’s annual awards

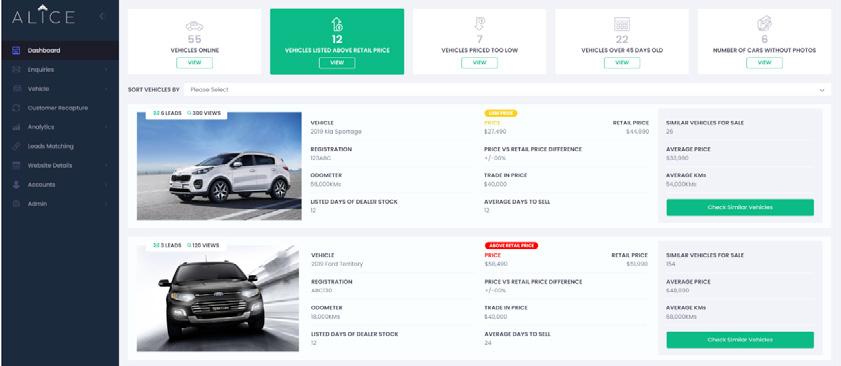

Pricing tool boosts your profit

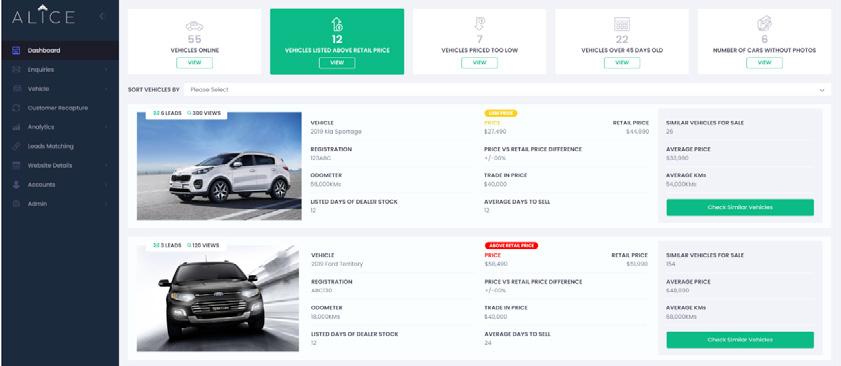

Back in the July 2022 issue of Autofile, I wrote about the launch of our new range of pre-owned vehicle tools.

This plug-in to our ALICE platform supports dealers in the sourcing and pricing of vehicles by consolidating, in one dashboard, the data on all cars listed online nationally at that specific moment.

At the time of writing that article, although optimistic, I was unsure how the market would respond to this technology given it was brand new.

Now – more than three months on – I can confirm the response from dealers has been fantastic with many thanking us for bringing this game-changing technology to New Zealand.

In seeing the tools first-hand, many have enquired about the possibility of further enhancing them. They have queried whether the technology can be personalised to their individual dealership, matching their data against the broader market with the aim of improving their inventory pricing processes.

Well, at AdTorque Edge, when the automotive industry speaks, we listen. And so, I can proudly announce that this month sees the addition of a dealership-specific

pricing screen to our existing pre-owned vehicle plug-in.

This newly built technology enables users to see, at a glance, a snapshot of how a dealership’s own listings are performing against the current online market.

Our ALICE platform matches market data against a dealer’s inventory listings and then clearly reports how many:

Vehicles they have listed above retail price.

Vehicles that are priced too low.

Vehicles they’ve had listed for more than 45 days.

Of the same cars are currently

listed nationally.

Days, on average, it’s taking the market to sell a specific vehicle type.

This information allows the dealer to quickly see where their vehicles are ranked against the online market.

They can then make necessary adjustments to their listings to ensure they remain competitive.

Such never-before-seen intel allows for educated decisionmaking, and more informed strategy development, with the ultimate goal of maximising profit.

I cannot overstate just how

effective the pre-owned vehicle sourcing, pricing and customer recapture tools have already proven to be in driving efficiency for used-car departments around the country and overseas.

While they aren’t here to replace the wealth of knowledge held by the industry, their aim is to assist sales managers, and buyers, to more effectively, buy and sell.

The pricing and sourcing of vehicles with these tools heralds a new era in New Zealand as we catch up with the rest of the world.

And the addition of this new dashboard empowers dealers with even more data to put behind stock management, saving them time and enabling them to make better, more informed decisions.

www.autofile.co.nz 17

Call (09) 887 1822 or email info@adtorqueedge.com | adtorqueedge.co.nz ADTORQUE EDGE WHO THE F@*K IS ALICE? CONTACT US TO FIND OUT! ADTORQUE EDGE

TODD FULLER General manager, New Zealand AdTorque Edge Zealand

Industry movers

FRANK WILLETT and ROBERT YOUNG are now on the board of the Imported Motor Vehicle Industry Association (VIA).

Willett is chief executive officer of Autohub NZ. He took up that position in January 2018 having been acting CEO since February 2017. Young is the manager director of Nichibo Japan Trading.

VIA chairman Chris Stephenson says: “We are lucky to have two people with such an expansive knowledge of our industry join our board. I would like to thank them both for volunteering their time.”

The other board members are Matt Battle, of Moana Blue, and Ken Quigley, of Jacanna Customs & Freight.

ELAINE OWEN has joined Avanti Finance’s senior executive team as head of product and markets.

The role involves supporting company growth and developing new products. She has experience in lending and across various market segments, such as retail, commercial and investment banking.

Owen was previously chief product officer at the Medical Assurance Society. Before that, she held a senior role at ANZ.

SEAN STEVENS has been appointed to the newly created position of membership services manager for the Motor Trade Association (MTA).

He is responsible for the delivery of services and benefits to members. The role encompasses mediation, human resource services, membership support and IT, as well as the gift and voucher, and regional co-ordination, teams.

Stevens was most recently chief executive of Vehicle Inspection NZ. Prior to that, he had several after-sales roles with Ateco Automotive.

AARON WALES has been appointed automobile sales manager at Suzuki NZ following Sheldon Humphries’ departure.

Wales has been with the company since 2016. He started in the motor vehicle and motorcycle technical department before progressing to a motorbike sales role.

Prior to this, Wales, pictured, worked at a Suzuki dealership. He has more than 15 years’ experience with the brand.

MIKE WALSH has been appointed chairman of DEKRA NZ, the parent company of VTNZ.

Walsh, pictured, led VTNZ for almost 14 years from 2004-18 before becoming executive vice-president for southern Africa and Oceania with DEKRA SE.

He has been a director on DEKRA NZ’s board since 2018 and replaces outgoing chairman Stan Zurkiewicz, who is stepping down to focus on his role as global chief executive officer of DEKRA SE.

DEBBIE PATTULLO has left Toyota NZ after a 30year career with the company.

The general manager of people and sustainability worked in many departments, including marketing, Lexus and business support.

Marque praised for green head office

BMW Group NZ has moved into new offices in Auckland after spending 32 years at premises in Mount Wellington.

The company says the shift aligns with its strategy to focus on sustainability and reduce its environmental impact, and comes as its portfolio of electrified vehicles expands.

The new premises are at The Mercury in Newmarket, a building that exceeds five-star certification by the NZ Green Building Council by harnessing natural light and air, and making use of recycled materials during its construction.

Its features include a large atrium with openings to deliver natural ventilation to reduce reliance on air conditioning and woven vinyl flooring with a high level of recycled materials. The site also has electric-vehicle charging facilities for use by staff and visitors.

Adam Shaver, managing director of BMW Group NZ, says the premises will help the company provide support to its dealer network.

He adds: “Our new office space is representative of our commitment to the New Zealand market and our aim to embrace sustainability across all areas of our business, while offering our staff a spacious environment in a fantastic location.”

Phil Goff, Mayor of Auckland, helped officially open the

premises on August 26 and was joined by BMW Group executives.

These included Jean-Philippe Parain, senior vice-president for Asia-Pacific, Eastern Europe and the Middle East, and Mike Wetherell, regional chief executive officer of BMW Group Financial Services for Asia-Pacific.

Also in attendance were Teresa Rice, BMW Group NZ Financial Services’ managing director, Wolfgang Buechel, CEO of BMW Group Australia, and May Wong, chief executive of BMW Group Financial Services Australia.

Goff says: “The office is an innovative space that includes sustainability measures in keeping with the company’s efforts to reduce its impact on the environment.

“As our city grows, we need to encourage such measures to continue working towards a more sustainable Auckland.”

News of the move comes in the wake of the company’s first half-year sales rising.

Registrations of fully electric BMWs saw quadruple percentage growth and sales of the Mini Electric Hatch notched up tripledigit percentage growth.

The group has bolstered its electrified range by launching fully electric models, such as the BMW iX3, iX and i4 Gran Coupe.

The i7 flagship sedan will debut this year and 2023 will see the arrival of the iX1, taking the group’s electrified portfolio to 10 models.

18 www.autofile.co.nz news

TO FEATURE IN INDUSTRY MOVERS EMAIL EDITOR@AUTOFILE.CO.NZ

Phil Goff, centre, cutting the ribbon. Also pictured, from left, are Wolfgang Buechel, Mike Wetherell, May Wong, Jean-Philippe Parain, Teresa Rice and Adam Shaver

Robert Young

Frank Willett

Industries separated by policy

Consumer law in New Zealand defines parallel imports as “genuine products, but the seller isn’t an authorised dealer of that brand”.

Until a few weeks ago, I understood this to include VIA members importing cars without the permission of the marque’s local authorised dealer.

Interestingly, I’ve found out the regulator doesn’t consider us parallel importers and, hence, goods we import aren’t parallel imports.

Instead, the regulator defines one as a new vehicle imported outside normal distribution channels. Under current regulations, this means only importers sponsored by original equipment manufacturers (OEMs) – local authorised distributors –can be parallel importers.

For some background, this country embraced parallel imports decades ago because there was insufficient competition in many industries, including automotive. The public was getting ripped off by high prices and lowspecification products, and the decision on parallel imports was seen as a pragmatic solution to boost competition.

Parallel imports were allowed to “make New Zealand goods markets more competitive and to ensure New Zealanders are paying internationally competitive prices for goods”, to cite a note in the Copyright Amendment Bill.

The government of the day understood it was self-regulating. If local authorised distributors provide the best prices and service, there’s no incentive or opportunity

for parallel importers to enter the market. This still holds true today.

Unfortunately, this is not what’s happening. While the Commerce Act specifically permits parallel importers, the Land Transport Act nullifies that by having rules allowing OEMs to prevent competition.

In addition, the regulator redefines parallel imports in a way that only applies to OEM-sponsored importers.

To be clear, according to the regulator, OEM-sponsored importers are “new car importers” if they import through their normal supply chains and “parallel importers” if they source vehicles outside of them.

I would be curious to see what sort of oversight the regulator provides for parallel imports. It appears their import processes mirror used imports except there’s no requirement vehicles be independently inspected, and all information supplied by the importer is assumed to be true and accurate. This makes sense if the regulator assumes the parallel importer is also the OEMsponsored importer.

I’m also curious how the regulator would reconcile this system with the stated intent of the Commerce Act in that it declares the local copyright holder, both the OEM-sponsored and parallel importer, and prevents anyone else from competing by parallel importing vehicles. This seems to block the Commerce Act’s intent.

I’m now trying to overcome my cognitive dissonance to figure out what it means for VIA’s members to not be parallel importers. I’m trying to rethink through industry dynamics, and how they relate to existing and proposed legislation and regulation.

The first obvious conclusion is the distinction between new and used-car importers is a real thing. This is a fundamental shift in my perspective.

I had always assumed the distinction was a convenient description based on areas of focus in the industry, but that it was flawed because the Commerce Act specifically allows goods to be imported without the permission of the local copyright holder and for those importers to compete on equal terms in a fair market.

I have always assumed we would eventually be able to overcome vestigial protectionist policies and be able to compete in the new-car space too.

I’ve been told repeatedly by a few colleagues this wasn’t the case and that used-car importers cannot compete in the new-car space, but I falsely assumed they were wrong and eventually we would rightly be able to compete as equals.

Now I understand that new and used-car importers are not a false dichotomy. They have clearly and purposely defined distinction. We aren’t a single competitive market. We are two markets selling two distinct products and subject to

two different sets of regulations.

I now understand what my colleagues have been trying to tell me. It is, by definition, impossible for a non-OEM-sponsored importer to bring in a new vehicle and compete in the new-car space.

I’m now torn on how to proceed. Should we fight this injustice or take advantage of it? If we are the suppliers of distinct goods, the onus to ensure policies effecting our goods are “fair” in relation to the new vehicles is gone or at least diminished. We can judge ourselves in isolation.

I am certain that if I was aware of this earlier, my advice to industry and government would be different. Take the clean car policies, for example, and the idea of shifting it to a per-vehicle basis and modelling that showed this would be equivalent over time came from me.

In hindsight, and with this new understanding in-hand, I wouldn’t have made that effort. I would have allowed the programme to influence manufacturers to work as designed and we would have demanded a separate system to influence used cars that wouldn’t disrupt our competitive supply dynamic.

Now I understand and hope everyone else does. We have two industries distinctly separated by government policy.

One has the goal of selling new vehicles that maximise international OEM profits and they are well-supported by government. The second industry, which the government just barely tolerates, is designed to provide quality used cars at prices Kiwis can afford.

www.autofile.co.nz 19 tech report

KIT WILKERSON Head of policy and strategy kit@via.org.nz

Advise • Advocate • Connect www.via.org.nz Imported Motor Vehicle Industry Association Advocate Advise Connect

The month that was... October

October 21, 1996

How bad will it be?

It was predicted that the next few years would be tough for the industry as dealers coped with falling used-vehicle values and the uncertainties of a nervous post-election market.

But the tough times weren’t expected to last long. Political stability and falling interest rates were forecast to boost pre-Christmas sales and set a positive tone for 1997.

The clear message from Wellington was, “don’t lose sleep over the outcome of Winston Peters’ power-broking, there’s only one way he’s going to go and that’s to the right”.

That would be good news for the retail car industry with a continuation of policies that ensured stability and good business prospects over the next two to three years.

While the media had a field day predicting a left-wing coalition, seasoned observers believed there was zero chance of Peters’ New Zealand First being sucked into teaming up with Labour and the Alliance. That was because National and NZ First had sufficient votes to go it alone.

October 28, 2005

LTNZ to review system

After losing a long legal battle, Land Transport New Zealand (LTNZ) had agreed to explore ways of streamlining the compliance process in cases when standard documentation was unavailable.

The government agency took Kiwi Auto Exports, owned by prominent industry figure Jerry Clayton, all the way to the high court in an attempt to keep a 1999 Ferrari 360 Modena, which was imported by Kiwi Auto in 2004, off the road.

That said, it was earlier in October 2005 the high court dismissed LTNZ’s review saying it was inconceivable the car would have been built to a lower standard than New Zealand regulations allowed.

Andy Knackstedt, LTNZ’s media manager, said the authority had agreed to set up a working party with the Independent Motor Vehicle Dealers’ Association and MTA to look at improving the system.